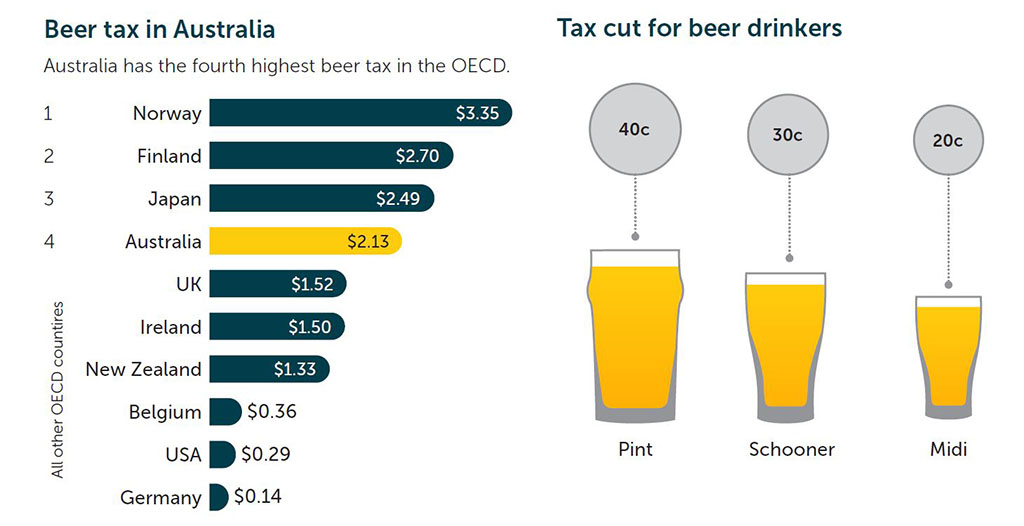

Did you know Australia’s beer tax rate is the 4th highest in the OECD and it has been going up twice a year for 35 years? With a pint of beer now over $10, catching up at the pub with mates for a beer is becoming unaffordable for many everyday Australians.

The Australian Hotels Association (AHA), Clubs Australia and the Brewers Association have joined

forces with Queensland pubs and clubs to call for urgent action to cut the draught beer tax which

increases again tomorrow.

Australians are dealing with cost-of-living pressures, and pubs and clubs which are struggling through COVID will be dealt another hammer blow tomorrow as the tax on draught beer is increased by the highest amount in ten years.

Australia already has the 4th highest beer tax in the world which has gone up twice a year for the

past 35 years. Tomorrow’s increase will take the draught beer rate to $36.98 per litre of alcohol – a

2.1% increase for the six-month period.

Queensland Hotels Association Chief executive Bernie Hogan said: “Twice a year for 35 years pubs and drinkers have copped a tax hike on draught beer. This year – after our members have done the right thing throughout the pandemic and at a time when jobs and businesses hang in the balance – we ask that pubs and drinkers get a break.

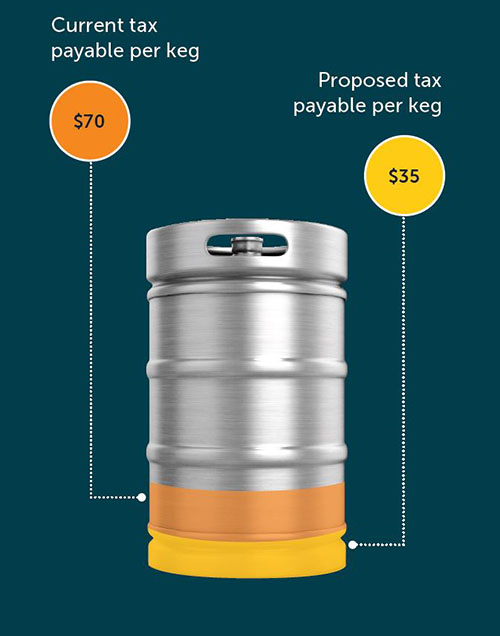

“Every beer poured in a glass through pubs and clubs creates local jobs, brings people together and enlivens communities. A tax cut of 50 per cent to the current excise rate would reduce the price of a schooner by about 35 cents turning the tap on some much-needed relief for beer drinkers and pubs.” said Bernie Hogan.

Paddo Tavern owner Matt McGuire said: “It’s part of our way of life in Australia that when someone is down we help them. “All of the hospitality industry did their bit in keeping Australians safe by shutting our doors and working to strict protocols. As a result, our businesses paid dearly, and we are still paying.

“We accept it was in the country’s best interests for us to take one for the team during the pandemic, we’re not asking for a handout just a decrease on the tax burden.”

Brewers Association of Australia, Chief Executive John Preston, said a 50 per cent cut in draught beer would reduce the Federal Government’s revenue from alcohol tax by only $150 million a year, or around 5% of total beer taxes collected.

He said the Federal Government had an opportunity in the upcoming Federal Budget to give pubs

and clubs a fighting chance. It will also provide relief for everyday beer drinkers.

“We are very concerned that on February 1, Australian beer drinkers will cop the biggest beer tax increase in more than a decade – it’s not right and it’s not sustainable. Other countries have been reducing their tax on draught beer to give pubs and beer drinkers a break,” Mr Preston said.

He said 11 million Australians visited the local pub or club at least once every three months and the industry employed hundreds of thousands of Australians. “The industry is telling us they want to help out their patrons as well as employ more as they rebuild,” Mr Preston said.“But the high level of tax is holding them back.”

Executive Director of Clubs Australia Josh Landis said: “The past two years have been the most challenging in the history of the club industry and the financial impact has been significant. A reduction in the beer excise would help clubs get back on their feet again while allowing them to keep supporting their local sporting teams, charities and other worthy community groups.”

About the Call for Australian Beer tax relief

The Australian Hotels Association, Clubs Australia and the Brewers Association are calling on

the Federal Government to deliver beer tax relief to pubs, clubs and Australian beer drinkers and other venues through a cut in draught beer tax.

We are asking for the draught beer rate to be reduced by 50 per cent to provide relief for pubs, clubs and beer drinkers.

- This would be a one-off decrease with the rate then increasing in line with CPI twice yearly following the reduction. The change would not impact the rates for pack beer.

- Beer and spirits are subject to an EXCISE TAX with rates per litre of pure alcohol in the product set by the Australian Government.

- A 50% reduction in the draught beer tax would mean the rate would drop from $36.98 per litre of pure alcohol to $18.49 per litre of pure alcohol for full strength draught beer.

Leave a Reply